While most teams focus on crafting complex machine learning systems, nearly 8 in 10 professionals rank evaluation as the decisive factor in project success. Predictive systems mean little if they can’t reliably translate to real-world outcomes—a truth that separates theoretical experiments from production-ready solutions.

The Python ecosystem simplifies this critical phase through libraries like scikit-learn, enabling practitioners to measure performance with surgical precision. Choosing the right yardstick—whether recall for cancer detection or F1 scores for fraud prevention—determines how technical achievements align with organizational goals.

Sophisticated frameworks now automate performance tracking, triggering alerts when accuracy drifts. This shift transforms static assessments into dynamic processes, ensuring models adapt as data evolves. Strategic metric selection becomes a competitive edge, guiding teams to prioritize outcomes that directly impact revenue or risk mitigation.

Key Takeaways

- Evaluation determines real-world model effectiveness more than algorithmic complexity

- Python tools enable precise measurement with minimal coding effort

- Metric choice must reflect specific business objectives and risk tolerances

- Cross-validation strategies prevent over-optimistic performance estimates

- Automated monitoring maintains model relevance in changing environments

Introduction to Model Evaluation Metrics in Python

Effective development of algorithms relies on measurable feedback loops—like a coach refining an athlete’s technique using stopwatch data. Quantitative assessments reveal whether systems deliver practical value or merely theoretical promise.

Understanding the Role of Evaluation Metrics

Performance indicators act as decision-making tools, converting raw predictions into actionable intelligence. A fraud detection algorithm might prioritize catching suspicious transactions over minimizing false alarms, while medical diagnostics demand near-perfect accuracy. These priorities directly shape metric selection.

Scikit-learn’s standardized functions eliminate guesswork. A single line of code calculates precision or recall, offering insights comparable to enterprise-grade platforms. This accessibility allows teams to focus on strategic improvements rather than technical implementation.

Importance in Optimizing Machine Learning Models

Iterative refinement separates functional systems from exceptional ones. Consider a retail recommendation engine: boosting click-through rates might reduce overall sales if suggestions favor popular items over profitable ones. Metrics highlight these trade-offs.

Seasoned practitioners balance multiple objectives using weighted scores. They also monitor temporal consistency—algorithms trained on yesterday’s data often degrade as consumer behaviors shift. Automated tracking tools now flag these drifts, enabling proactive adjustments.

Key insight: The right measurement framework turns abstract computations into boardroom-ready narratives. It’s not about chasing perfect scores—it’s about aligning numbers with operational realities.

Understanding Classification vs Regression Evaluation Metrics

Predictive systems face a critical fork in the road: will they predict categories or quantities? This fundamental choice dictates which performance yardsticks matter most—a decision that shapes how teams validate success.

Differences Between Binary Classification and Regression Tasks

Binary classification thrives on crisp decisions. Email filters labeling messages as spam or not, medical tests flagging diseases—these systems succeed when they minimize incorrect yes/no calls. Metrics here focus on error types: false alarms versus missed detections.

Regression tackles continuous outcomes. Housing price predictions missing by $50,000 carry different consequences than being off by $5,000. Here, metrics measure error magnitude—how far predictions drift from actual values.

Choosing the Right Metric for Your Problem

A retail demand forecast using regression might prioritize mean absolute error to understand average prediction gaps. Meanwhile, a fraud detection system would optimize recall—ensuring most fraudulent transactions get caught, even if some legitimate ones get flagged.

Probability outputs add nuance. Credit risk scores assigning default likelihoods allow banks to adjust approval thresholds based on economic conditions. This flexibility disappears if models only output binary “approve/deny” decisions.

Strategic selection tip: Map metrics to decision impact. If mistaken predictions cost $10,000 each, even 95% accuracy could be disastrous. Sometimes, error costs matter more than overall correctness.

Fundamentals of the Confusion Matrix

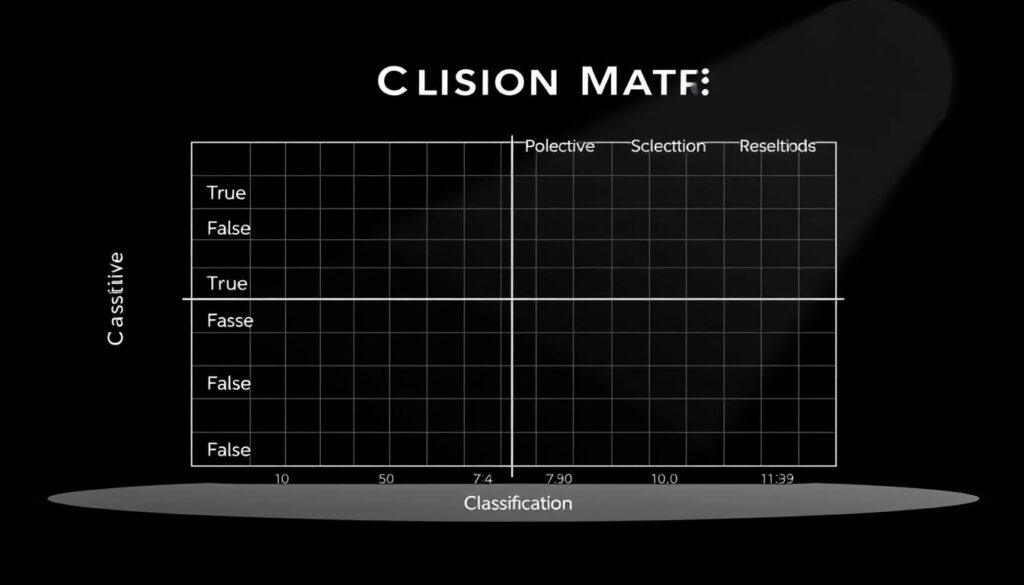

Every classification system needs a truth-telling mirror—a tool that reveals not just overall accuracy, but the specific patterns behind correct and incorrect predictions. The confusion matrix serves this role with surgical clarity, transforming abstract performance claims into actionable insights.

Core Components: TP, TN, FP, and FN

At its heart, the matrix breaks predictions into four critical categories. True positives (TP) represent correct identifications of target events—like valid fraud alerts. True negatives (TN) reflect accurate dismissals of non-events, such as correctly cleared security checks.

| Component | Definition | Business Impact |

|---|---|---|

| False Positive | Incorrect alarm (Type 1 Error) | Wastes resources on non-issues |

| False Negative | Missed detection (Type 2 Error) | Allows critical issues to slip through |

Consider a cybersecurity application: 10,000 daily login attempts. A matrix might show 9,850 TN (legitimate users), 120 TP (true threats), 25 FP (false alarms), and 5 FN (undetected breaches). Those 5 missed threats could cost millions.

Implementing this framework through Python’s scikit-learn library takes minutes but delivers lasting value. Teams gain visual confirmation of where models excel or struggle—whether distinguishing product categories or detecting network intrusions.

Strategic analysis begins by asking: Which errors hurt most? Credit approval systems prioritize reducing false negatives to avoid losing good customers. Cancer screening tools minimize false positives to prevent unnecessary biopsies. The matrix makes these trade-offs explicit and measurable.

Key Classification Metrics: Accuracy, Precision, and Recall

The true effectiveness of a classifier unfolds through three lenses: accuracy’s broad view, precision’s focus, and recall’s vigilance. These measurements form a diagnostic toolkit for assessing prediction systems—each revealing different aspects of performance.

Balancing Correct Predictions with Misclassifications

Accuracy offers a straightforward success ratio: correct guesses divided by total attempts. It works well when classes are equally distributed—like distinguishing cats from dogs in balanced image sets. But in fraud detection where 99% of transactions are legitimate, 98% accuracy might mean missing most criminal activity.

Two specialized metrics address this limitation:

| Metric | Focus | Business Scenario |

|---|---|---|

| Precision | Prediction quality | Reducing false alarms in spam filtering |

| Recall | Detection completeness | Catching 95% of defective products |

Precision answers: “When we flag an issue, how often are we right?” High precision matters when false positives waste resources—like unnecessary fraud investigations. Recall asks: “What percentage of real problems did we catch?” Medical diagnostics demand high recall to avoid missing sick patients.

Practical implementation requires:

- Prioritizing precision when false alarms cost more

- Emphasizing recall when missed cases create risk

- Adjusting prediction thresholds based on error impacts

A credit approval system might tolerate 20% false positives to achieve 90% recall—accepting some bad loans to avoid rejecting good customers. This strategic balancing transforms technical metrics into profit-protecting tools.

The F1 Score: Balancing Precision and Recall

Imagine a financial auditor who must identify suspicious transactions—too many false alarms waste resources, while missed fraud risks collapse. The F1 score operates similarly, balancing two critical classification metrics through mathematical harmony.

This score calculates the harmonic mean of precision and recall, favoring systems that perform well in both areas. Unlike simple averages, the harmonic mean severely penalizes lopsided performance. A classifier with 90% precision but 50% recall would have an F1 score of 64.3%—lower than its arithmetic mean of 70%.

| Metric | Formula | Use Case | Business Impact |

|---|---|---|---|

| F1 Score | 2*(Precision*Recall)/(Precision+Recall) | Balanced error costs | Fraud detection systems |

| F-beta Score | (1+β²)*(Precision*Recall)/(β²*Precision+Recall) | Prioritizing recall/precision | Medical diagnosis tuning |

The F-beta variant adds flexibility. Set β=2 to prioritize recall for cancer screening—capturing more true cases despite some false alarms. Use β=0.5 for spam filters where precision matters most.

This metric shines in scenarios with uneven class distributions. Customer retention models benefit when both identifying at-risk clients (recall) and avoiding unnecessary interventions (precision) hold value. Teams often use F1 during cross-validation to compare algorithms objectively.

Strategic implementation requires asking: Do false positives or negatives cost more? The answer determines whether to optimize F1, F-beta, or individual metrics—turning mathematical calculations into profit-protecting decisions.

ROC Curve and AUC: Evaluating Binary Classification

Navigating classification performance resembles reading a compass—the ROC curve charts the course between detection power and error risks. This visual tool reveals how systems balance critical trade-offs at every decision threshold.

Interpreting True Positive and False Positive Rates

The true positive rate measures detection success: “How many real threats did we catch?” Its counterpart—the false positive rate—exposes unnecessary alarms. Together, they form the ROC curve’s axes, mapping performance across all possible thresholds.

| AUC Range | Performance Grade | Real-World Use Case |

|---|---|---|

| 0.9 – 1.0 | Excellent | Medical diagnostics |

| 0.8 – 0.9 | Good | Credit risk assessment |

| 0.7 – 0.8 | Fair | Marketing lead scoring |

| 0.6 – 0.7 | Poor | Basic spam filtering |

Deriving Meaning from AUC Scores

A perfect area roc curve score (1.0) means flawless separation of classes—rare outside controlled tests. Most production systems aim for 0.8+ scores. As one data scientist notes:

“AUC tells you if the model can rank order predictions, while the curve shows where to set thresholds.”

Strategic teams analyze both the score and curve shape. A high AUC with a steep early rise suggests strong low-risk detection—ideal for fraud prevention. Stability across shifting data makes this approach vital for systems facing evolving patterns.

Advanced Metrics in Classification: Sensitivity and Specificity Insights

Critical detection systems demand more than basic accuracy—they require surgical precision in identifying threats while minimizing false alarms. Sensitivity and specificity provide this dual lens, revealing how classifiers handle high-stakes decisions.

Optimizing Detection with TPR and Specificity

Sensitivity (True Positive Rate) measures a system’s ability to catch real threats—like identifying 98% of malware infections. Medical teams prioritize this to avoid missing diseases. Specificity focuses on avoiding false alarms, crucial for systems like credit approvals where unnecessary rejections damage customer trust.

Balancing these metrics requires strategic trade-offs. A cancer screening tool with 95% sensitivity might flag 10% healthy patients—costly but necessary. Security scanners achieve balance by adjusting thresholds: higher sensitivity during peak travel, increased specificity for trusted travelers.

Advanced practitioners use error metric frameworks to quantify business impacts. Retail fraud systems might tolerate 15% false positives to catch 90% of fraud—a calculated risk protecting revenue without overwhelming investigators.

Mastering this balance transforms technical metrics into profit-protecting strategies. It’s not about perfect scores—it’s about aligning detection power with operational realities.

FAQ

How do classification metrics differ from regression evaluation metrics?

Classification metrics like accuracy, precision, and recall focus on categorical outcomes—measuring correct predictions against misclassifications. Regression metrics, such as mean absolute error (MAE) and mean squared error (MSE), quantify numerical deviations between predicted and actual values. The choice depends on whether the task involves discrete classes or continuous outputs.

When should precision be prioritized over recall in binary classification?

Precision becomes critical when minimizing false positives is essential—for example, in fraud detection or spam filtering. Recall takes priority when missing positive cases carries higher risks, like medical diagnoses. The F1 score offers a balanced view by calculating the harmonic mean of both metrics.

What does the AUC-ROC curve reveal about a model’s performance?

The area under the ROC curve (AUC) measures how well a binary classifier distinguishes between classes across all thresholds. A higher AUC (closer to 1) indicates strong separation of true positive rates and false positive rates, while lower values (near 0.5) suggest random guessing.

Why is sensitivity important in imbalanced datasets?

Sensitivity (true positive rate) highlights a model’s ability to correctly identify minority-class instances, such as rare diseases or equipment failures. Combined with specificity (true negative rate), it helps optimize detection in scenarios where class distributions are skewed.

How does the confusion matrix improve model interpretation?

By breaking predictions into true positives, true negatives, false positives, and false negatives, the confusion matrix clarifies where errors occur. This granularity supports targeted adjustments—like reducing false negatives in safety-critical systems or refining thresholds for better precision-recall trade-offs.

Can MAE and MSE be used interchangeably for regression tasks?

While both measure prediction errors, MAE averages absolute differences (robust to outliers), whereas MSE squares errors—penalizing large deviations more heavily. MSE is preferred when significant errors are unacceptable, while MAE offers intuitive interpretation for average error magnitude.